We Build Your Business

WE PAY: Secretary of State Fees, Domain name & Hosting, (10) Page Website, 500+ Business Registrations, 800 Number, Business Address, Registered Agent, Press Release, & Much More!

WE PAY: Secretary of State Fees, Domain name & Hosting, (10) Page Website, 500+ Business Registrations, 800 Number, Business Address, Registered Agent, Press Release, & Much More!

Everything provided in one place. Total Business Building Services. We are naturally driven to succeed. Build your business and start making money in as little as 30 days!

Business Startup Package: An affordable way to ensure you build business credit that starts off on the right foot! WE MAKE YOU LOOK GREAT ONLINE & ON PAPER!

Now, for the first time ever, starting a business has never been easier, with all necessary startup compliance requirements and many additional services provided in one place.

The crucial decision remains…

Would you prefer to embark on a challenging, costly, and unpredictable journey that might not succeed, or opt for a streamlined path to develop your business confidently alongside a partner committed to realizing your vision every day?

What your about to see below has NEVER be provided by another company online. The reason? It demands genuine effort and unwavering commitment to accomplish all tasks.

This service will NOT be found anywhere else!

Our dedication is unmatched, fueled by a fervent desire to see others succeed in leaving a legacy in their path.

You can legally establish a Secondary Personal Guarantor separate from your SSN personal credit profile With a 750 plus credit score and $150,000 in open credit reporting if you have bad personnel credit (scores under 650)

Already have a business with just the basics set-up?

No problem! Save $500 on an established business.We’re here to guide you through every step, ensuring you meet the specific underwriting requirements that lenders and credit issuers demand. With our expertise, you can secure approvals tailored to your business’s unique legal standing and EIN, no matter where you are on your journey.

Even if personal credit challenges are holding you back, we offer innovative solutions like No Personal Guarantee (No PG) credit options.

Our support doesn’t stop there. We help you lay the foundation for robust business credit with 1st tier Trade Line Approvals and 2nd tier Business Credit Cards—all based on your business credit alone.

No matter your background or business type, our business advocacy program equips you with everything you need to secure the funding necessary for growth and success.

Remember, your business is unique, and so is the corporate credit strategy we design for you. It’s time to build the credit that will take your business to the next level.

Your new company will have an individuality that sets it apart from every other business on your street, in your town, and around the world.

![]() Expedited LLC filing

Expedited LLC filing

![]() Registered Agent

Registered Agent

![]() LLC Membership Certificates

LLC Membership Certificates

![]() Articles of Organization

Articles of Organization

![]() EIN Document for printing (PDF)

EIN Document for printing (PDF)

![]() Operating Agreement

Operating Agreement

![]() Online Notary Credit for Operating Agreement (if needed)

Online Notary Credit for Operating Agreement (if needed)

![]() Annual Worry-Free Compliance

Annual Worry-Free Compliance

![]() Commercial Address on Business Filings

Commercial Address on Business Filings

![]() Business mail forwarding

Business mail forwarding

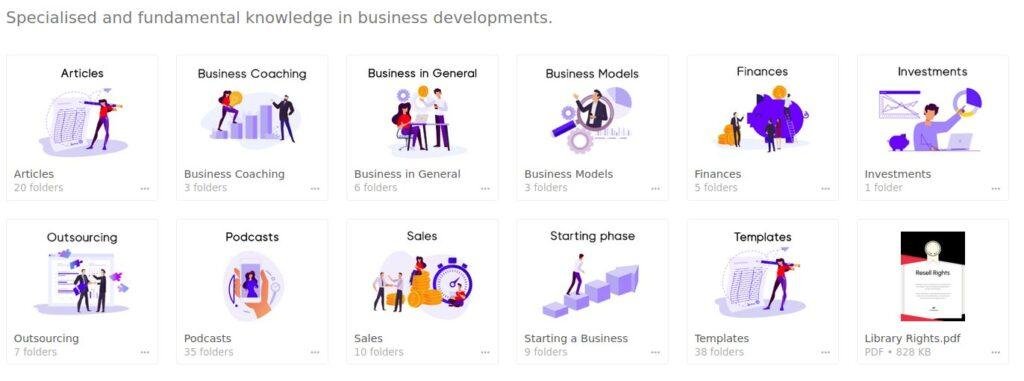

![]() Business Documents Library

Business Documents Library

Already have a Business? Get $500 OFF.

Already have a Website? Take $1000 OFF

ESTABLISH A STRONG & SOLID REPUTATION!

BUILD BUSINESS CREDIT WITH US!

Price "Includes" All Filing Fees, Domain Name, Hosting, Listings, 800#, Business Address & Much More!

(3) decades ago, we all embarked on our entrepreneurial journey.

It was a rollercoaster of highs and lows, triumphs and setbacks, with plenty of unsolicited advice from the sidelines.

Along the way, we encountered a pivotal realization: our initial lack of proper knowledge was a significant barrier to our success.

Understanding the essentials was not just an obstacle we had to overcome; it was the cornerstone of our business achievements.

We learned to work hard, but the real game-changer was learning to work smart—a concept we initially knew nothing about.

Driven by a curiosity to uncover the secrets of successful entrepreneurs, we dove  deep into the world of business.

deep into the world of business.

Countless hours later, we mastered website building, leveraged advanced SEO strategies, navigated the complexities of business registration, and decoded the essentials of fast-tracking business credit—all crucial skills that propelled our ventures.

After creating several multimillion-dollar businesses and briefly flirting with retirement, we realized our true passion lies in the throes of entrepreneurship.

After creating several multimillion-dollar businesses and briefly flirting with retirement, we realized our true passion lies in the throes of entrepreneurship.

We decided to compile our wealth of knowledge into a comprehensive, done-for-you business startup package designed to eliminate the guesswork for fellow entrepreneurs.

Imagine having a polished, profit-ready business setup waiting for you, complete with a fully optimized website, advanced SEO, business listings, press releases, and much more.

Our package also includes vital market insights and social media setup, ensuring you’re primed for credit approvals and poised for success in your desired niche.

Presenting our Business Credit Build Out Package—your all-in-one solution to launching a successful business, backed by our proven methods and insider knowledge.

Hearing feedback like, “I am highly grateful for your dedication and service to our vision,” fuels our commitment to transforming our clients’ dreams into reality, often turning them into lifelong friends.

Hearing feedback like, “I am highly grateful for your dedication and service to our vision,” fuels our commitment to transforming our clients’ dreams into reality, often turning them into lifelong friends.

We’re more than just a service; we’re a community passionate about empowering small businesses.

Whether you’re rekindling your entrepreneurial spirit or sketching out business plans over coffee, we’re here to guide, mentor, and support you.

Why not reach out? At worst, you’ll gain invaluable insights with no strings attached—a win in our book.

Plus, we relish any opportunity to talk shop. Beyond the financial rewards, helping others succeed is the most exhilarating experience we’ve discovered.

May your entrepreneurial path be blessed,

Your Serial Entrepreneur Team,

LNCF

🚀 Ah, the entrepreneurial spirit – that relentless drive compelling you to leave the soul-sucking 9-to-5 grind, forge your path, and unfurl your “Grand Opening” banner. It’s a wild ride, chock-full of caffeine-fueled late nights, elevator pitches that go up and down more than the market, and more optimism than a fortune cookie factory.

But let’s face it, there’s a line they don’t print on the glossy brochures or mention in those hyper-enthusiastic start-up podcasts: building a business is like playing a board game, except the pieces are on fire, the rulebook is in Aramaic, and every time you pass ‘Go’, your credit score laughs maniacally in the distance.

So, you want to build business credit, huh? You think it’s high time your business had a credit score that opens doors instead of one that gets door-slammed by lenders. I get it. In the pantheon of business, credit is like the mythical golden fleece – everyone’s heard of it, but not many know how to wrestle that shiny beast into their portfolio.

To the uninitiated, the quest to build business credit can feel like being asked to fill out a tax return with your non-dominant hand – sure, it’s possible, but you’re going to question every choice you’ve ever made along the way. And those mistakes? They come with extra zeros at the end, and not the kind that come after a one on a paycheck.

But fear not, noble business crusaders, for I come bearing tales of a mythical turnkey solution, a golden key designed to unlock the enigmatic treasure chest of business credit without having you end up like a modern-day Blackbeard (sans the piracy, parrots, and, well, ultimate defeat).

But fear not, noble business crusaders, for I come bearing tales of a mythical turnkey solution, a golden key designed to unlock the enigmatic treasure chest of business credit without having you end up like a modern-day Blackbeard (sans the piracy, parrots, and, well, ultimate defeat).

Just imagine if there was a way to sidestep the traditional byzantine credit-building rigmarole in favor of a streamlined, almost magical process. A process so smooth, you’d think it was lubricated with the tears of entrepreneurs who came before you, but oh-so-much happier.

So buckle up, dear captains of industry between the ages of 35-55. Whether you’re a grizzled veteran of the start-up wars or a bright-eyed bushy-tailed newcomer to the game, you’re about to embark on an adventure that’ll leave your business credit score shining brighter than a PowerPoint slide on maximum bulb brightness. We’re going to dive into the wonderful world of building a bastion of credit so formidable that even the strictest of lenders would tip their hats (and open their vaults) to you.

Intrigued? You should be. What awaits is no less than the business equivalent of finding a map where ‘X’ marks the spot – but instead of a shovel, you’ll be armed with a savvy turnkey solution. Stay tuned, because things are about to get as exciting as an account reconciliation party – and yes, that’s business humor for “hold onto your calculators, it’s going to be a wild ride.”

Imagine stepping into the financial coliseum as a fledgling entrepreneur; you’re the underdog, and your opponent? A snarling, complex creature known as ‘Business Credit.’ You’ve heard the stories whispered in hushed tones over lattes and laptops – how this beast can either make or break your business empire dreams. It’s the make-it-or-break-it, the do-or-die, the… well, you get the metaphor. Business credit is essential, the lifeblood of your company’s financial reputation, and here’s why:

Just as Rome wasn’t built in a day, neither is business credit. It’s a slow, meticulous process of stacking those bricks of trust between you and the financial world. Each transaction, each payment, and every line of credit is another brick in your fortress of financial credibility. A strong business credit profile tells lenders, “This is no fly-by-night operation; this is a business that stands tall and pays bills on time, every time.” It’s like having a wingman that always says the right thing about you at a networking event.

Let’s tackle the cash flow quandary. Any business, irrespective of size, craves the freedom that comes with healthy cash flow. When suppliers give you a thumbs up for net-30 or net-60 payment terms, it’s a game-changer. It means you can manage operations, roll out marketing campaigns, and even cater the odd Friday office brunch without choking your bank account. Why? Because you, my friend, have proven to be as trustworthy with money as a squirrel is with nuts.

Now, onto the superhero aspect of building business credit – shielding your personal assets from the arrows of business liability. Without a strong business credit, entrepreneurs often put their personal credit on the line, and that’s like betting your pants in a high-stakes poker game. With solid business credit, the line between personal and business doesn’t just blur – it becomes a fortress wall that keeps your personal credit score waving high, safe from the potential sieges of business mishaps.

Imagine a VIP pass to the most exclusive club – the ‘Capital Club.’ Here, funding opportunities flow as freely as the bubbly. Building business credit grants you an all-access pass to various forms of financing – loans, leases, credit lines – all because lenders see you as the VIP of reliability. It’s like getting backstage passes to every rock concert in town; only this time, the rockstars are the banks, and the music is the sweet sound of cash registers.

Finally, let’s not forget the gravitational pull a stellar business credit profile has on opportunities. From negotiating better rates with suppliers to impressing potential business partners, your credit score is like a magnet drawing in deals and alliances. It’s the charismatic business partner that can schmooze its way into any deal.

Yet, as essential as it is, building this golden credit reputation often feels like trying to juggle flaming torches while balancing on a unicycle. Each misstep can lead to a fiery tumble of interest rates or, worse, a burnt relationship with a lender.

The traditional method of building business credit is comparable to performing a symphony solo, with you playing every instrument. It’s like a juggling act where you’re tossing compliance documents, financial statements, and vendor applications into the air, hoping to catch them all in perfect harmony. A daunting task, indeed.

But what if there was an ensemble ready to harmonize the music for you? A comprehensive turnkey solution that works in unison to build your business credit score into a crescendo of credibility? This solution isn’t just a helping hand; it’s a full-blown personal business concierge service that takes the baton and conducts the entire orchestra on your behalf.

In the upcoming sections, we’ll introduce you to the concept of total turnkey solutions for building a business, which is akin to having an entire pit crew in the racing world of entrepreneurship. We’ll delve into the elegant machinery behind these services and how they can orchestrate your startup’s growth with the grace and efficiency of a world-class conductor. Say goodbye to the frantic, frenetic juggling and hello to the finesse of a seamless credit-building strategy. Stay tuned as we pull back the curtain on the wizardry of turnkey solutions that promise not only to simplify the startup process but also lay a strong foundation for unshakeable business credit.

Enter the realm of entrepreneurship, where the startup journey often resembles navigating through a labyrinth with nothing but a half-broken compass: daunting, confounding, and fraught with the potential for dead-ends. But what if I told you that a Minotaur-proof map exists? An ingenious compass that not only guides you but also clears the path, sets up camp, and ensures that you emerge as the hero? That’s the promise of our comprehensive turnkey solution – it’s the entrepreneurial equivalent of a Swiss Army knife on steroids.

When you set forth on your venture, the need to ‘Build business credit’ becomes as palpable as the ground beneath your feet. But how does one tackle this multi-headed hydra without getting bitten by the high-interest rate serpent or ensnared in the quicksand of credit invisibility? The answer lies within the unassuming power of the turnkey solution offered by our company, a blueprint to building your business credit with the precision of an architect and the artistry of a maestro.

The journey commences at the bedrock: establishing your corporate identity. Our service hands you a corporate scalpel to carve out your niche in the bedrock of commerce. A business entity is more than a name on paper; it’s your cape and cowl in the marketplace. With meticulous precision, we aid you in registering your business, ensuring that every legal and regulatory tedium is as delicately handled as a bomb squad diffuses a volatile device.

With the corporate identity forged, the next act in our ‘business opera’ is securing your financial foundation. It’s time to lay down the carpet for future financiers to walk upon. We procure a dedicated business phone number, craft a professional mailing address, and set up the necessary accounts – turning your startup into a beacon for credit opportunities. Think of it as Cinderella’s fairy godmother, but instead of a pumpkin and some mice, she’s conjuring up a fiscal chariot and loyal credit builders.

Now to the crescendo: conducting the credit orchestra. Our turnkey solution ensures your credit narrative sings in harmony with the needs of credit bureaus and lenders. We facilitate your business credit file creation with Dun & Bradstreet, Experian, and Equifax, turning what is often a cacophony of confusion into a symphony of financial credibility. Each record, each transaction, each credit application becomes a note in your opus of reliability.

You’re the protagonist in a tale of networking, and our role is akin to the seasoned matchmaker. Through vendor introductions and strategic partnerships, we weave a web of connections that’s as robust as it is intricate. These relationships aren’t just handshakes and exchanged business cards; they’re the seeds of trust that will blossom into the sweet fruit of net terms, laying the groundwork for improved cash flow without squeezing your wallet to a pulp.

Imagine a voice, not just any voice, but a voice that exudes the gravitas of your enterprise every time the phone rings. Our live call answering service is your business’s maître d’, providing a touch of class and ensuring that every caller receives the red-carpet treatment. It’s about making an impression, the kind that etches your brand into the caller’s mind like an indelible ink stamp.

Dance through the steps of compliance with the grace of a waltz, avoiding the regulatory missteps that many unwary entrepreneurs encounter. From EIN registration to state filings, each precise movement is choreographed to perfection, positioning your enterprise as the belle of the ball in the eyes of lenders, investors, and credit bureaus alike.

Branding isn’t just about slapping a logo onto products; it’s about imprinting your corporate DNA onto every aspect of your business. With website design and marketing collateral, our turnkey solution ensures your brand resonates with the market, much like how a peacock flaunts its feathers – with purpose, pride, and panache.

This total turnkey solution isn’t just a service; it’s an ecosystem of business growth, a network of opportunities, and most importantly, a fortress of credit-building prowess. It’s akin to having a special key to every door in the city of commerce. Gone are the days when building business credit was akin to navigating a maze blindfolded; welcome to the era where every turn is anticipated, every roadblock dismantled, and the path to credit excellence is as clear as daylight.

The business world waits for no one, and in this fast-paced arena, it’s not just about keeping up; it’s about staying ahead. With the turnkey solution, the chaos of the startup process is tamed, the complexity is simplified, and the ultimate goal of building robust business credit becomes not just achievable but inevitable. It’s time to lift the fog, clear the stage, and let your business play the starring role in its own success story.

As we prepare to explore the step-by-step enactment of this grand opera, remember that in the pursuit of business credit, every act counts, every scene matters, and with the turnkey solution in your repertoire, the standing ovation of financial success is just a curtain call away.

So, you’ve got the vision, the gusto, and the unshakable conviction that your business idea will conquer the marketplace. Fantastic! But before you charge headfirst into the corporate colosseum, you’ll need to gear up—and I’m not just talking about caffeinated beverages and motivational posters. You’ll need a strategy that’s sharper than a tack, and that’s where the turnkey solution comes strolling in, wearing its superhero cape, ready to rescue you from the abyss of administrative anarchy. Let’s dive into how this unsung hero works its magic, step by methodical step.

Imagine, if you will, your business as a fledgling phoenix, eager to rise from the ashes of a thousand failed startups. But every mythical bird needs a name—enter the first step of our turnkey solution: crafting your corporate identity. Like a skilled alchemist, our team transmutes the base metals of your business concept into the gold of a legally-registered entity. Rest easy, no need for you to chant legalese or dabble in the dark arts of bureaucracy; our experts have you covered from Articles of Incorporation to that all-important EIN.

Now, before we let the orchestra play on, it’s important to tune our instruments. Think of your business credit as a delicate violin string—too loose, and it flops lifelessly, too tight, and well, let’s just say it’ll snap under pressure. Our prelude to building business credit involves setting you up with the likes of Dun & Bradstreet, Experian, and Equifax. This isn’t some dance with the devil; we’re more like a financial fairy godparent, ensuring that when midnight strikes, your creditworthiness remains in the limelight.

A business without a professional address is like a knight without armor—vulnerable and frankly, a little underdressed. Our turnkey solution presents you with a mailing address that does more than receive letters; it sings your company’s presence from the rooftops. This isn’t just any mailbox; it’s your brand’s homestead, the cornerstone of your commercial castle. And worry not, there’ll be no jousting with postal mishaps on our watch.

A dedicated business phone number is your hotline to the market, and we ensure it’s as smooth as a Sinatra melody. With call answering services that would put the politest butler to shame, you’ll never miss a beat. Each call answered is like a note played in your business symphony, contributing to a harmonious brand image. This isn’t a one-man band; it’s a full ensemble at your beck and call.

In an age where digital presence is king, not having a website is akin to waltzing alone in the dark. Our turnkey solution partners you up with the best in design, and together, we create an online ballroom where your business can dance with grace. This waltz doesn’t just attract admirers; it lays down the welcome mat for search engines and customers alike, turning clicks into credit-building handshakes.

Tiptoeing through the compliance minefield can be less ‘Swan Lake’ and more ‘Swan Dive’ if you’re unprepared. Fortunately, your turnkey partner is a deft choreographer, leading you in a compliance cavalcade that wows every regulatory audience. From state filings to license renewals, we ensure every pirouette is performed to perfection, keeping your business en pointe.

A pirouetting piranha? Unlikely. Your branding needs to be just as distinct—no aquatic carnivores in tutus here. With branding services that tackle everything from logo design to marketing material, your business will execute a ballet that mesmerizes the marketplace. Each twirl, each leap, an articulation of your unique brand narrative—poised, dignified, and destined for an encore.

In the nocturne of networking, it’s not just whom you know; it’s who knows you. The turnkey solution doesn’t just introduce you to influential players; it composes a nocturne that draws them to your side of the stage. As your business credit blossoms under the moonlit sonata of strategic partnerships, you’ll find the pathway to capital paved with the gold coins of goodwill.

And so, our turnkey tale unfolds—not with a cliffhanger, but with the promise of a business credit fortress, built stone by stone with deft precision and bespoke care. Every act in this opera has been composed with your success as the crescendo. It’s a tale where the quill has met the ledger, and the legend of your enterprise is inked not with ifs and maybes, but with the certainty of a creditworthy empire.

Now, as the lights dim and you contemplate the symphonic journey that lies ahead, remember—the turnkey solution isn’t just about writing the score; it’s about conducting the orchestra to the tune of triumph. And as for the humor, well, let’s just say, we keep it in ‘account’ for every ledger line.

Ah, dear reader, gather ’round the campfire of commerce, and let me regale you with tales of triumph, where the champions of the turnkey realm rose to acclaim and creditworthiness. These are not tall tales told in the dark whispers of Wall Street alleyways but veritable odysseys of ordinary business warriors who turned the tide with a total turnkey solution. Through the murky waters of entrepreneurship, they navigated their ships to the golden shores of Business Credit Island.

Our first saga begins with Sir Start-up-a-lot, a bold but beleaguered entrepreneur who, before finding the Holy Grail of turnkey solutions, was afloat in a sea of spreadsheets. His credit castle was but a house of cards, susceptible to the slight breezes of financial skepticism. Enter the trusty turnkey steed—a service that prances in and deftly crafts a corporate identity so sharp that it cut through red tape like a hot knife through a spreadsheet.

The transformation was like watching a caterpillar turn into a cash-flow butterfly. With a corporate façade as polished as a knight’s armor, and the credit-building machine working in the background, Sir Start-up-a-lot went from jester to jesting with financiers at the round table. He obtained credit lines that were previously the stuff of legend. His gratitude? Immortalized in ledger lines, his business credit score sang songs of ascension.

Next, let me spin you a yarn about Ollie the Online Storekeeper, whose e-commerce enterprise was hidden in the foggy lowlands of the internet, invisible to the almighty search engines. His digital presence was thinner than a page in a pamphlet. The turnkey solution waved its magic wand, and lo, a website worthy of the cyber-gods was born. It wasn’t mere hocus-pocus; it was the alchemy of artistry and analytics.

Within this site lay the secrets to business credit alchemy, turning customer clicks into a treasure trove of credibility. Ollie’s business now basked in the glow of online reverence, and his financials glistened with a newfound respectability. No longer did he barter with the bandwidth imps; he was building credit that reached Olympian heights.

Ah, dear Fred, a freelance philosopher with a penchant for procrastination. His kingdom of one was as organized as a dragon’s diet—utterly chaotic. But then, the turnkey wizards bestowed upon him an administrative fortress so robust that his invoices and contracts became the envy of every mercantile mage in the market.

With their guidance, Fred’s business credit soared. His fiscal fortress stood firm against the onslaught of high-interest rates, and vendors began lining up, offering terms of net everlasting. Fred, once tangled in the brambles of billing, now conducted his business with the poise of a lion king surveying his financial savannah.

Permit me to pen a final vignette featuring the Consulting Connoisseurs, a cohort of wise wizards whose advice was as sought after as a unicorn’s counsel. Yet, in the financial arena, they were but apprentices. The turnkey touch granted them an address that didn’t just whisper but trumpeted their prestige from every corporate rooftop, and a dedicated phone line as answered by the sylphs of service themselves.

A testament to their transformation—once their business credit was built like a fortress of knowledge, opportunities flowed like a babbling brook of bounty. Their tales of fiscal fortitude are spoken of in hushed tones in the corridors of commerce.

My dear entrepreneurs, these are not just stories; they’re parables of possibility. For each business owner who partook in the turnkey feast, a banquet of benefits followed. They built their business credit not on the shifting sands of chance, but on the solid bedrock of structured solutions.

As the curtain falls on these accounts of ascent, we pivot to a matter that stirs in the loins of every self-respecting businessman—the return on investment. Brace yourselves, for we shall soon venture into the caverns of cost-benefit analysis, a realm where many a brave soul has ventured in pursuit of the holy grail of profitability. Here, the DIY approach meets its nemesis, and the bottom line emerges victorious, not vanquished.

And so, we sashay down the golden path to the hallowed halls of Return on Investment (ROI), that ever-glinting beacon that draws in entrepreneurs like moths to the flame of fiscal responsibility. In the great banquet of business decisions, the ROI reigns as the main course, with appetizers of risk and side dishes of cost lurking around the plate’s edges. Fear not, for here’s where our turnkey solution sets a feast fit for a king, and like a skilled maître d’, we shall present to you the pièce de résistance: a savory dish of tangible benefits, spiced with just the right amount of humor to tickle your bottom line’s taste buds.

Firstly, we must turn our gaze to the direct monetary benefits, a straightforward delight that’s easy on the palate. If the currency were calories, then consider the turnkey solution as your business’s gourmet diet plan; a regimen so finely tuned that it trims the fat from your start-up costs while nourishing your business credit with the finest of fiscal proteins. Think of the expenses spared from eschewing an office lease, the kind that feasts upon your capital like a voracious financial Pac-Man. By adopting a virtual office, your company gains a lustrous corporate veneer sans the soul-sucking overheads.

Then, there’s the tantalizing time-saving tango. Time, that most elusive of spices, is seasoned throughout every step of the turnkey process. Whereas the DIY approach forces you to juggle tasks like a circus performer with slippery hands, the turnkey solution grants you the agility of a time-saving trapeze artist, each swing a graceful arc that bypasses hours of mind-numbing bureaucracy. With the paperwork pandemonium pawned off to your turnkey partner, you reclaim those precious hours and convert them into strategizing succulence, devising delicacies of business growth.

Let’s not overlook the zest of professional seasoning added to your enterprise. Your startup, under the aegis of a total turnkey solution, gains the type of credibility that whispers sweet nothings into the ears of financiers and suppliers alike. Credit lines, once a dreamy dessert on an unreachable menu, become a reality as you brandish a business credit score that opens financial floodgates. This is credit couture, my friends, a fashion of finance so tailored, your business struts down the economic runway with the confidence of a supermodel.

On to the marinated expertise in compliance and paperwork preparation—those dreary but necessary ingredients that too often spoil when left in inexperienced hands. The turnkey solution presents them expertly prepared, each filing and form al dente, ensuring your business is not only palatable to regulatory palates but also a veritable feast of legitimacy. Imagine the DIY disasters, akin to kitchen nightmares, where one slip of the pen could summon the health inspector of the business world. Now, imagine the turnkey solution as your expert chef, whipping up compliance with a flair that would make even the sternest of auditors salivate in approval.

Consider the ROI in terms of risk, the uninvited dinner guest that every business owner learns to feed but never entertain. The DIY approach is akin to fumbling with a cookbook in a foreign language, where each mistranslated ingredient could spell disaster for your dish. But with a turnkey solution, the risk is calculated with the precision of a master chef’s recipe, measured to the gram, guaranteeing a result that is nothing short of sublime. This meticulous management of risk is akin to having an insurance policy on your banquet, ensuring each course leads to satisfaction, not food poisoning.

In the grand finale, we come full circle to the pièce de résistance—a business credit profile so robust it would make Midas green with envy. Here lies the crown jewel of your ROI, a gleaming gemstone set in the ring of your company’s financial future. For the turnkey solution doesn’t just lend you a temporary throne on which to perch precariously; it constructs a palatial empire in which your business can reign supreme. With each step in the business credit realm strategically planned, your company moves like a queen on the chessboard of commerce, powerful and unchallenged.

Now, draw your chair closer, for the next act in our play of profitability is about to commence. Picture the stage set with strategic business moves, a game of chess with high stakes and grand ambitions. Here, the knights and bishops are not merely pieces but the very lifeblood of your enterprise, and choosing the right partner in this grand game can be the difference between a swift checkmate or a slow, withering defeat. Prepare yourself, as we delve into the strategic sagacity afforded by the turnkey solution, where building business credit becomes a royal conquest.

In the grand theatre of commerce, building business credit through turnkey solutions is akin to a grandmaster’s play in chess, where the board is the marketplace and every move is a strategic endeavor to fortify one’s position. Here, in this intricate game, every pawn, knight, and bishop serves a pivotal role in the quest for financial supremacy, and wielding a turnkey solution is like playing with an extra queen on the board.

Entrepreneurs often step into the arena as eager neophytes, their minds abuzz with visions of empire. Yet, the stark reality of business warfare soon reveals itself. Credit building, a silent guardian of the commercial fortress, often stands as a stout barrier to the uninitiated. But those who align with the sagacity of a turnkey provider transform from mere players into architects of their own victories. Like castling in chess, it safeguards the king—your business—while positioning the rook—your credit profile—to dominate the open files of financial opportunity.

Picture this: with a turnkey solution, each play you make is calculated, each risk astutely assessed. Just as a chess player must be mindful of their positional play, in business credit building, every decision reverberates throughout your enterprise’s future. Do you march your pawn forward to claim space in the market, or do you develop your knights and bishops—your business’s infrastructure and credit—to control the center? A turnkey solution whispers the ancient stratagems of commerce into your ear, guiding each decision to echo through the halls of economic conquest.

And in this game, as much as it is about the moves you make, it is also about the moves you don’t. The blunders and pitfalls, akin to leaving your king exposed or your queen en prise, are expertly sidestepped when a turnkey provider oversees your business’s evolution. They build not just credit, but fortifications against market volatility, unfurling your business banner on parapets built upon the bedrock of strategic financial planning.

In chess, one’s eloquence on the board is defined not by aggression alone but by the poise of one’s defense. Similarly, a robust business credit is not solely an offensive weapon but a shield—a protective layer that dampens the blows of economic upheaval. In times of austerity or plenty, a formidable business credit profile crafted through turnkey solutions stands unyielding, allowing you to pivot, adapt, and ultimately capture the king—market dominance.

Let us then raise the banners high and sound the horns of triumph, for the turnkey approach to building business credit is not just a pathway but a declaration of intent. It signals to competitors that you are not merely playing the game but rewriting the rules, crafting a legacy of strategic advantages with the precision of a grandmaster. It is the clarion call that echoes: “Here stands an entrepreneur, a strategist, one who sees beyond the next move to the endgame of business ascendancy.”

Now, with the battlefield set and pieces aligned, we step forward into the tapestry of tailored strategies, where each thread weaves a stronger fabric of business potential. The turnkey approach awaits, like a masterful artisan ready to sculpt the future of your enterprise—a future as bespoke and fitting as a tailored suit, each stitch a testament to your vision and ambition.

Imagine, if you will, your business as a distinguished gentleman stepping into the world’s most esteemed tailor’s shop. There, amidst the soft clink of measuring tapes and the rustle of fine fabrics, a transformation is about to unfold. This is not just any sartorial affair; this is the process of fashioning a suit that feels less like clothing and more like a second skin—meticulously designed to the unique contours of the gentleman’s ambitions. So too is the nature of the turnkey solutions your business is about to don.

These turnkey solutions are no off-the-rack offerings. We’re talking about a personalized concierge service for your business needs, understanding that ‘one size fits all’ is a myth peddled by carnival hucksters and not by those vested in your financial success. Your company is as individual as your fingerprint, and the strategies to build business credit must be tailored with the same individuality.

The process begins with the tape measure of due diligence, taking every aspect of your business into account: industry, size, age, and aspirations. This is not just about fitting a template to your company; it’s about weaving the very fabric of the service around it. Each recommendation is hand-picked, each resource allocated with precision, and each strategy is deployed with the deftness of the finest tailor’s needle.

Like the subtle stitches that hold a lapel’s roll in place, the nuances of your business are addressed in every step of the turnkey strategy. Perhaps your digital presence is akin to a frayed cuff, needing the attention of a craftsman to rebind the edges and present a face to the world that exudes confidence and credibility. Or, your existing business credit is the equivalent of a misaligned button, one strategic adjustment away from perfect alignment.

The strategy does not stop at mere aesthetics, however. A turnkey solution ensures that your business’s structure, much like the robust interfacing hidden within a suit’s chest, is fortified to withstand the tests of time and market pressures. Your business entity setup, your compliance checks, they are all scrutinized and secured, providing the foundation upon which the sophisticated outer layers of your business credit can be built.

Consider also the lining of the suit—often unseen but utterly essential. In the realm of business credit building, this is the infrastructure you erect within your enterprise: the operational processes, financial reporting systems, and management practices. All these elements are seamlessly integrated into your tailored turnkey package, ensuring functionality and finesness not only catch the eye but also promote sustainable growth.

As your business steps out of the proverbial changing room, donned in the bespoke turnkey solutions tailored to its every need, it does so ready to walk the commercial runway. Your business is ready to turn heads with a credit profile as sharp as a three-piece suit on Wall Street. But this is no ephemeral fashion statement. This is the enduring mark of credibility, reliability, and distinction, ready to make an indelible impression on lenders, suppliers, and customers alike.

Remember, in this age of instant gratification and template solutions, the power lies in the personal touch. The curation of a bespoke strategy is a testament to the care and attention invested in your enterprise’s future. The execution of such a plan is not unlike watching a master tailor at work: each motion is deliberate, each thread selected with intention, and the final product is nothing short of a masterpiece.

And so, gentlemen entrepreneurs, step boldly into the haberdashery of business credit building. Let the bespoke turnkey solutions envelop your enterprise, transforming it into the business equivalent of a man who knows that the true power of a suit lies not just in its appearance but in its meticulous construction and perfect fit for the man within. It’s time to show the marketplace not just that you mean business, but that you define it.

Now, let’s descend from the tailor’s loft and into the grand bazaar of action, where your moves determine your market might. You’ve been fitted with the knowledge of our personalized turnkey strategy, and it’s time to march forward with purpose. Here is your map to navigate the bustling streets of business credit building and how to rally the forces of our turnkey solution to your banner.

The journey begins with a single, decisive step: reaching out to our business credit concierge. Imagine this as dialing into your dedicated strategist, who’s poised to tackle the labyrinth of credit building on your behalf. It’s as simple as picking up the phone or shooting off an email – think of it as pressing the ‘Go’ button on a game of Monopoly, except in this version, you have a top hat-wearing ally guiding each roll of the dice.

Upon establishing contact, your initial consultation awaits, a veritable war room where the battle plan is drawn. This is where your business aspirations are mapped out, much like a star quarterback drawing plays in the dirt. Here, we will customize the blueprint of your credit building game plan. You’ll delve into the intricacies of your enterprise, forecasting future maneuvers and identifying potential allies in the financial sphere.

With strategy in place, the rapid deployment of your business infrastructure begins. No more fumbling with registration forms or compliance jigsaw puzzles. We’re the pit crew to your racing enterprise, changing your tires and fine-tuning your engine at lightning speed. Our turnkey solution fast-tracks the setup of your business entity, your EIN, and all those compliance checkpoints that otherwise feel like hurdles on a track.

With your enterprise’s foundation as solid as a fortress, the crusade for credit can commence. This is where our squadron of credit builders step in, strategically establishing your presence with credit bureaus, opening trade lines with the finesse of a chess grandmaster. This phase is akin to planting your company’s flag on the peaks of the business landscape, declaring readiness to lenders far and wide.

To build business credit, you need troops in the form of credit relationships. Under the turnkey umbrella, vendor lines of credit, credit cards, and loans are not elusive will-o’-the-wisps but rather steadfast allies ready to bolster your business ranks. Imagine drawing forth Excalibur as vendors and lenders extend their trust, swayed by the professional readiness your enterprise exudes.

As the landscape shifts and your business evolves, you will not be abandoned in the field. The turnkey solution is a partnership, a council of advisors offering ongoing support and intelligence. Reports, alerts, and updates will be your ravens and messengers, keeping you abreast of your growing credit profile and market opportunities.

Now comes the moment to seize the day. Activate your bespoke turnkey solution and propel your business from the trenches of obscurity into the limelight of creditworthiness. Let us raise the ramparts and draw the bridges of opportunity for your business. Reach out and let our experts do the heavy lifting, while you orchestrate the symphony of your business’s success from the conductor’s podium.

Business nobility, your chariot awaits. Take the reins of this turnkey solution, and ride toward the horizon of business growth and exceptional credit. Your kingdom of commerce will thrive under the banner of creditworthiness, and your legacy as a sage business sovereign will be etched in the annals of the marketplace. All it takes is your command to begin.

Frequently Asked Questions: Debunking Myths and Clarifications

Q1: Can’t I just use my personal credit to fund my business? Why bother building business credit?

Let’s cut right to the chase: sure, you can throw your personal credit into the ring with your business expenses, but it’s like using a steak knife to saw down a tree. Functional? Barely. Advisable? Not if you prefer your financial sanity intact. Building business credit is like crafting a sturdy, separate financial persona for your business – it grows your company’s borrowing capacity without holding your personal assets hostage whenever your business eyes a new opportunity.

Q2: Do business credit scores really make a difference to lenders?

In the world of finance, a business credit score is like your business’s SAT score when applying to Ivy League colleges. Without it, lenders are just taking your word for how brilliant your business is. With it, you’re showing off a gleaming scorecard of reliability. It can mean the difference between a polite, “We’ll get back to you,” and a red-carpet rollout to the vault.

Q3: Isn’t building business credit a long, complicated process?

Let’s not sugarcoat it – it’s not a walk in the park, but it’s also not rocket science. It’s more like building a LEGO empire; it takes the right pieces, patience, and following a blueprint – which is where a turnkey solution turns a jigsaw puzzle into a paint-by-numbers.

Q4: How quickly can I expect to build a solid business credit profile?

Ah, the age-old question of haste versus speed. Like a fine bourbon, building a full-bodied business credit profile doesn’t happen overnight. But with a total turnkey solution, you can fast-track the process. Think of it as having a backstage pass to the business credit gig – you’re not skipping the concert, you’re just getting to the good parts quicker.

Q5: Can I build business credit if my personal credit isn’t stellar?

Absolutely. While your personal credit score is the financial equivalent of your high school GPA, business credit is your chance at a clean slate in college. Our turnkey solution doesn’t give you a cheat sheet but rather tutors you to excel in Business Credit 101, no matter what your personal credit report card looks like.

Q6: Do all lenders and suppliers consider business credit scores?

Most do – the savvy ones, at least. Think of lenders and suppliers as potential dates. Some might swipe right based on charm alone, but many want to check out your business’s ‘credit dating profile’ first to ensure they’re not about to dine with a financial dine-and-dasher.

Q7: Will using a turnkey solution to build business credit cost me an arm and a leg?

Not unless you’re shopping for solutions in a pirate’s market. Investing in a turnkey solution is like opting for an all-inclusive holiday; you might gulp at the price tag at first, but once you realize it includes everything from setup to execution, you’ll be lounging business-class without the fear of hidden costs.

Q8: Isn’t managing business credit something I can do on my own?

You could, in the same way you could cut your own hair – it’s possible, but is it advisable? A DIY approach to business credit is fraught with potential mishaps. Our turnkey solution is like having a personal financial stylist – sure, it’s a bit more upfront, but the results are a cut above and won’t leave you wearing a hat for the next six months.

Q9: How do I ensure my business credit remains strong after building it?

Maintaining strong business credit is like keeping fit after a diet; it’s all about healthy habits. Regular check-ups, responsible credit use, and keeping your debts as trim as a spin class enthusiast’s waistline are key. Our turnkey solution doesn’t just help you bulk up your credit, it keeps your business in shape with ongoing support.

Q10: Will building business credit help me secure investment for my business?

In the eyes of an investor, your business credit score is akin to LinkedIn recommendations; the better your endorsements, the higher your chance of connecting. Solid business credit signals to investors that your company is more than just a pretty business plan; it’s a robust, trustworthy enterprise.

Q11: Do I need a certain amount of revenue to build business credit?

Business credit doesn’t discriminate by size; it’s the great equalizer. Whether you’re a mighty corporation or a scrappy startup, you can start building credit posthaste. It’s not about how much you earn but how effectively you manage and leverage your financial relationships.

Only if you let it. When you mix personal and business finances, you’re tangling up your worlds like headphone wires at the bottom of a bag. By building separate business credit, you’re untangling the cords. That way, if your business hits a bump, your personal assets aren’t automatically thrown under the bus.

Business Credit Hashtags:

#businessloan #businesscreditcard #businessloans #businessfinance #corpay #businescreditcards #businesscreditrocks #businesscreditbuilder #businesscredit #businesscreditscores #buildbusinesscredit #creditrepair #creditrepairworks #creditrestoration #businessscan #businessfinancing #businessfinancingsolutions #businessfunding #workingcapital #workingcapitalloans #workingcapitalloan #workingcapitalforsmallbusinesses #getapprovednow

business loan, business credit card, business loans, business finance, business credit builder, business credit, business credit scores, build business credit, business financing, business funding

businessloan, businesscreditcard, businessloans, businessfinance, businesscreditbuilder, businesscredit, businesscreditscores, buildbusinesscredit, businessfinancing, businessfunding

You can trust your brand with us regardless of the type of business you have.

Here is a brief description of some of the services that we offer to our clients.

Startup Funding

Startup Funding for Business

Startup Funding for Small Business

Startup Funding Website

Start-up Funding For Nonprofits

Startup Funding Companies

Startup Funding Options

Startup Funding Sources

Startup Funding Stages

Startup Funding Online

How Startups Get Funding

Business Funding

Business Funding For Startups

Business Funding Solutions

Business Funding With Bad Credit

Business Funding Fast

Small Business Funding

Business Funding Partners

Business Funding For Veterans

Business Funding Group

Startup Funding Capital

Small Business Loans

Small Business Loans For Woman

How to Get Small Business Loans

Small Business Loans for Startup

Small Business Loans for Veterans

Small Business Loans Rates

Small Business Loans Near Me

Rates for Small Business Loans

Small Business Loans for Minorities

How Do Small Business Loans Work

Small Business Loans New Business

Small Business Loans Online

Small Business Loans for Disabled Veterans

Qualifications for Small Business Loans

Small Business Loans Unsecured

Where to Get Small Business Loans

Small Business Loans Quick

Small Business Loans Companies

Small Business Loans Amount

Unsecured Loans

Unsecured Loans Personal

Unsecured Loans vs Secured

Unsecured Loans for Business

Unsecured Loans Online

Unsecured Loans Debt Consolidation

Unsecured Loans to Consolidate Debt

Unsecured Loans Rates

Rates for Unsecured Loans

Unsecured Loans Near Me

Unsecured Loans Interest Rates

Unsecured Loans for Veterans

Unsecured Loans Types

Unsecured Loans Best Rates

Unsecured Loans Low Interest

Unsecured Loans Companies

Creative Financing

Creative Financing Options

What is Creative Financing

Creative Business Financing

Creative Financing Ideas

Creative Financing Strategies

Creative Financing Solutions

Real Estate Investor Loan

Real Estate Investor Financing

New Venture Funding

Secured Loans

Secured online loans

Secured Loans for Bad Credit

Secured Loans with Bad Credit

Secured Loans for Business

Secured Loans vs. Unsecured Loan

Secured Loans Rates

How Does Secured Loans Work

Secured Loan Debt Consolidation

Secured Loan Collateral

Secured Loans Types

Start-up Business Loan (Bad Credit Rating)

Start-up Business Funding

Business Funding for Startup

Startup Business Loan Rates

How to apply for Startup Business Funding

SBA Loans

SBA Loans Requirements

SBA Loans Rates

SBA Loans (504)

SBA Loans Disaster

SBA Loans for Veterans

SBA Loans for Woman

SBA Loans Business

SBA Loans Interest Rate

Terms for SBA Loans

SBA Loans Real Estate

SBA Loans Types

SBA Loans for Small Business

SBA Loans Programs

SBA Loans Applications

MCA Loans

MCA Business Loans

Merchant Cash Advance

Merchant Cash Advance Companies

Merchant Cash Advance Loan

What is Merchant Cash Advance

Merchant Cash Advance Bad Credit

Shark Loans

Shark Loans Online

Shark Loans and Bad Credit

Funding for Companies

Funding Companies

Funding Companies for Startups

Funding for Small Companies

Business Lines of Credit

Lines of Credit for Business

Lines of Credit Loans

Lines Credit Personal

Lines of Credit for Small Business

Lines of Credit Online

How do Lines of Credit Work

Equity Lines of Credit Rates

Lines of Credit Rates

Interest Rates for Lines Credit

Lines of Credit vs. Loan

How to Get Lines of Credit

Business Lines of Credit Rates

Apply for Lines of Credit

Lines of Credit Loans for Bad Credit

Lines of Credit for New Business

Lines of Credit for New Businesses

Lines of Credit on Investment Properties

Business Lines of Credit Interest Rates

Lines of Credit Basics

Best Personal Lines of Credit

How Line of Credit Work

How to Get the Funding for a Business

How to Get Funding to Start a Business

How to Get Funding for Startup

Best Funding Options

Entrepreneur Funding

Funding for Entrepreneur

Social Entrepreneur Funding

Business Capital Loan

Capital for Small Business

Working Capital for Small Business

Small Business Funding

Small Business Funding for Startups

Small Business Funding StartUp

Small Business Funding Options

How to Get Small Business Funding

Small Business Funding Companies

Business Credit Line

Business Credit Builder

How to Build Business Credit

Funding for Startup Business

Funding for Entrepreneurship

Funding for Startup Nonprofits

Funding for Startup Restaurants

Funding for Social Entrepreneurs

Funding for Tech Startup

Funding for Female Entrepreneurs

Funding for My Startup

Restaurant Funding

Funding for Restaurant Startup

Funding for Gyms

Financing a Yoga Studio

Funding for Fitness Programs

David Allen Capital

Fundwise Capital